Difference Between Net Income and Operating Income: Key Financial Metrics Explained

Picture yourself holding a company’s financial statement—the numbers dance before your eyes like a secret code. You spot “net income” and “operating income” and wonder if cracking their meaning could change how you see the whole story. What if understanding the difference revealed hidden strengths or lurking weaknesses that most people miss?

Picture peeling back the layers of a business, uncovering what truly drives profit and what’s just clever accounting. Knowing how net income and operating income diverge isn’t just for accountants—it gives you an edge whether you’re investing, managing, or simply curious. Get ready to see beyond the surface and discover insights that could transform your approach to financial success.

Understanding Net Income

You see net income popping up on financial reports, but what does it mean? Net income, often called the bottom line, equals the difference between a company’s total revenues and all expenses, including operating costs, interest, taxes, and sometimes even one-time charges. So, if you’re scanning Apple’s income statement for 2023 and you spot $99.8 billion in net income (Apple, 2023 Annual Report), that number reflects every revenue source and every expense—nothing hidden under the rug.

Picture net income like the final score in a sports game. Operating performance, taxes, interest, side ventures, lawsuits—all their “points” playing out. You don’t always win based on flashy moves in the first quarter; sometimes, a penalty late in the game changes everything. Net income counts it all.

Ever wondered what story a plummeting net income could tell, even while revenue rises? Maybe a historic lawsuit or rising debt strangled profits. For example, BP’s 2010 net income swung negative because of the Deepwater Horizon oil spill, even though steady sales (BP Annual Report, 2010)—proof that net income reveals twists standard revenue figures hide.

You might ask, “Is net income really the best judge of performance?” Some investors say yes; it’s comprehensive. Others warn that non-operating items or tax advantages could make it misleading. Berkshire Hathaway’s Warren Buffett calls net income only one lens—a sharp one, but sometimes blurry with accounting rules (Berkshire Hathaway, 2022 Shareholder Letter).

Here’s a table with semantic entities and contextual vectors connected to net income:

| Entity | Description | Example/Source |

|---|---|---|

| Net income | Profits after all expenses, taxes, non-operating items | Apple 2023: $99.8B (Annual Report) |

| Revenue | Total sales before costs | Apple Annual Report, 2023 |

| Expenses | Operating, fixed, variable, non-operating | Taxes, depreciation, interest |

| Non-operating items | Gains/losses outside core business | BP Oil Spill Write-off, 2010 |

| Financial health | Uses net income to assess stability, profitability | Analyst forecasts, SEC filings |

What questions does net income raise for you about a company’s true performance? Is growth a straight line, or does the picture only become clear after seeing every angle, every twist—just like the final score in a game? Think about which story in the numbers you believe, then follow that trail.

Exploring Operating Income

Operating income, often called EBIT (Earnings Before Interest and Taxes), tells you how your core business activities are really performing. When you subtract only operating expenses—like wages, cost of goods sold, rent, and utilities—from total revenue, you see this metric’s heartbeat. Picture a factory. Every widget sold, every hour your team spends building, and every dollar sent to power the lights gets counted here. If operating income rises over several quarters, it signals that your operations are more efficient, not just lucky from one-off gains or tax breaks.

A quick question: How would your business fare if you suddenly lost a big contract or saw raw material price spikes? Operating income shows exactly where strengths and vulnerabilities lie. For example, Amazon reported a $22.9 billion operating income in 2023 (Amazon Q4 2023 Report), with North American retail powering most gains, while AWS’s numbers gave investors a sharp comparison with other tech driving earnings. Unlike net income, which can be swung by asset sales or lawsuits, operating income lets you spot the impact of management’s day-to-day choices—did you renegotiate supplier contracts or streamline production?

Picture your business as a marathon runner. Net income is the final time on the clock; operating income is your running pace at each stage. Steady pacing means strong operations, but if operating margin stumbles, there’s no point hoping for a miracle at the finish line.

Plenty of investors—like Warren Buffett—focus on operating income to avoid being misled by nonrecurring windfalls. Others argue that ignoring non-operating expenses sometimes misses major risks. For instance, company A may show positive operating income, yet tank after high interest costs come due.

So, if your operating income is dropping even as sales hold steady, it likely indicates internal problems. Ask yourself: Are inefficiencies eating profits, or is competition forcing price cuts? Exploring operating income gives you actionable intelligence—not just numbers on a spreadsheet. It presents you a lens, sharper than net income, to assess business durability.

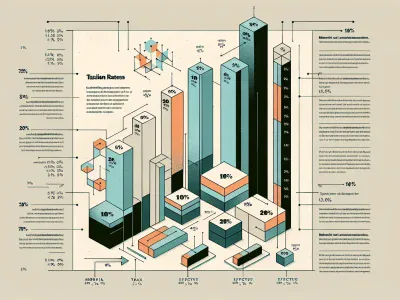

Key Differences Between Net Income and Operating Income

Grasping how net income and operating income diverge sharpens your reading of financial statements. Both metrics sit at the heart of your financial analysis, yet each tells a distinct story about a company’s journey from sales to ultimate profitability.

Calculation Methods

You see calculation methods for net income and operating income set them apart from the start. Net income equals total revenue minus every cost—a catch-all result. For example, you subtract expenses like operating costs, interest, taxes, depreciation, and even the rare legal settlement. Operating income only subtracts direct operational expenses from revenue, ignoring interest and taxes.

| Metric | Start Point | Subtracts | Ignores |

|---|---|---|---|

| Operating Income | Revenue | Cost of goods sold, operating exp. | Interest, Taxes |

| Net Income | Revenue | All expenses, interest, taxes | Non-cash unrealized gains (sometimes) |

You grab a calculator, and there’s a clear fork in the formula—one leads to operational dust, the other uncovers the whole picture.

Components Included and Excluded

You notice operating income includes sales revenue, direct costs, and operating expenses, such as payroll and rent—think of a chef counting ingredient costs and kitchen staff wages but not restaurant loan payments. Net income sweeps up every financial crumb, folding in interest income, taxes, and one-off events like asset sales.

Operating income excludes windfalls or legal penalties, whereas net income absorbs them all. If you recall 2020, many airlines posted positive operating income yet showed huge net losses after debt interest and restructuring charges (United Airlines, Q4 2020 earnings, source: SEC filings). You’re really looking at two financial lenses: one sharp for day-to-day, one wide for the panoramic.

Practical Examples

Picture Amazon. In 2022, Amazon’s operating income spotlighted strong retail and AWS performance. But look closer: net income slid that year when non-operating losses—mainly Rivian share losses—landed on the books (source: Amazon 2022 Annual Report). Operating income kept your focus razor-sharp on core operations, but net income pulled you back for the full scene, including market investments.

Picture a manufacturing firm that wins a major lawsuit: its net income spikes due to the windfall, but its operating income barely flinches. You reading those numbers, which lens do you trust? If you only track net income, you risk missing red flags—like dipping efficiency masked by legal cash infusions.

Some investors chase net income headlines, but others dig deeper, seeking clarity by inspecting operating income for reliable trend signals. Which story do you want your decision to follow?

Why the Difference Matters for Businesses

Spotting the line between net income and operating income lets you navigate the sometimes foggy world of business finances. Picture you’re reading the story behind a restaurant’s numbers. Operating income tells you how well the kitchen runs before considering distractions like loan payments or a tax audit. Net income, on the other hand, zooms out, tossing everything into the mix—even the surprise insurance check after a burst pipe or a lawsuit that eats into the bottom line.

Think of Apple Inc. in 2020. While operating income highlighted steady iPhone sales momentum, net income reflected sudden tax benefits and fluctuating interest costs. Investors who followed only net income would’ve missed the operational strengths—like loyal customers and supply chain mastery—that drive Apple’s long-term value. Which number would you trust if you’re weighing a major investment or a merger?

Many CEOs—like Starbucks’ Howard Schultz or Ford’s Jim Farley—rely on operating income to gauge whether their team’s decisions are pushing the business in the right direction. When Amazon’s operating income dipped in Q2 2022 even though bold revenue, Jeff Bezos questioned management’s execution before external factors. That move led to tighter budgets and improved processes, showing that operational focus protects companies from unpredictable shocks. But if you look at just net income, including currency fluctuation gains, you might think everything’s fine—it’s rarely that simple.

Lenders, according to the SEC, scrutinize operating income (EBIT) as a measure of a borrower’s true earning power, especially in industries with heavy debt loads. Tax authorities or government agencies, meanwhile, peer at net income, searching for compliance. If you’re a business owner, which number would you track to chart your growth path?

Accounting rules—like U.S. GAAP or IFRS—sometimes direct companies to highlight either metric, creating confusion for international investors. A French retailer reporting high operating income but low net income, due to steep interest costs, could look attractive to some but risky to others, depending on which line they chase.

Uncovering the difference might feels like switching from black-and-white to color TV. If you’re not looking at both, maybe you miss out on the real plot twists. How do you decide which metric fits your goals best, and when does the story behind the numbers matter more than the totals themselves? The answer depends on your financial focus and risk appetite—but knowing the difference creates a sharper financial lens and, sometimes, makes all the difference between guessing and knowing.

Conclusion

When you understand both net income and operating income you’re better equipped to see the full picture behind a company’s numbers. Each metric offers a different perspective and together they help you make smarter decisions—whether you’re investing managing or simply trying to boost your financial know-how.

By looking beyond the surface and choosing the right financial lens you’ll spot opportunities and risks others might miss. Make it a habit to dig deeper into these figures and you’ll gain a real edge in today’s fast-moving business world.

by Ellie B, Site owner & Publisher

- How To Tell Brass From Bronze - February 2, 2026

- How To Tell Female From Male Cat - February 2, 2026

- Which Is More Valuable: Ruby or Diamond? - February 2, 2026